I News

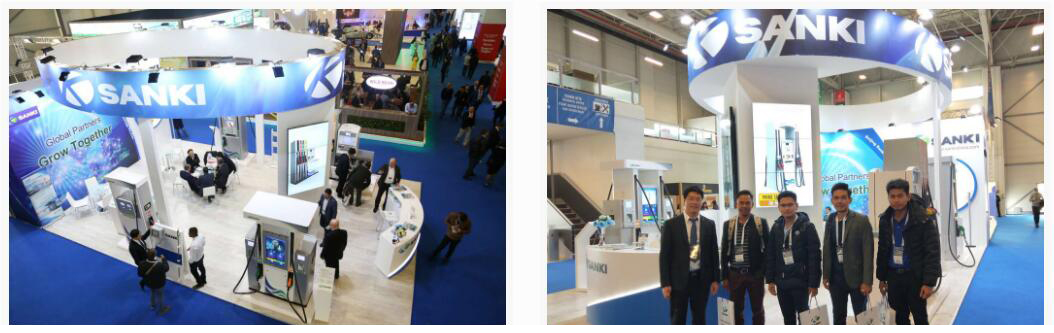

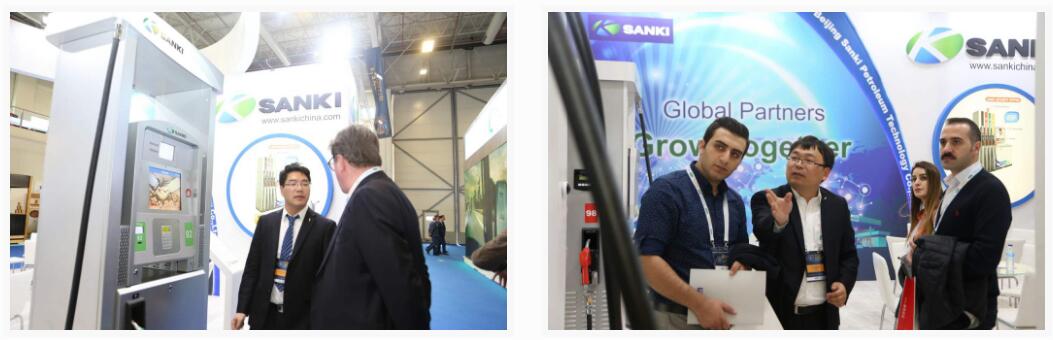

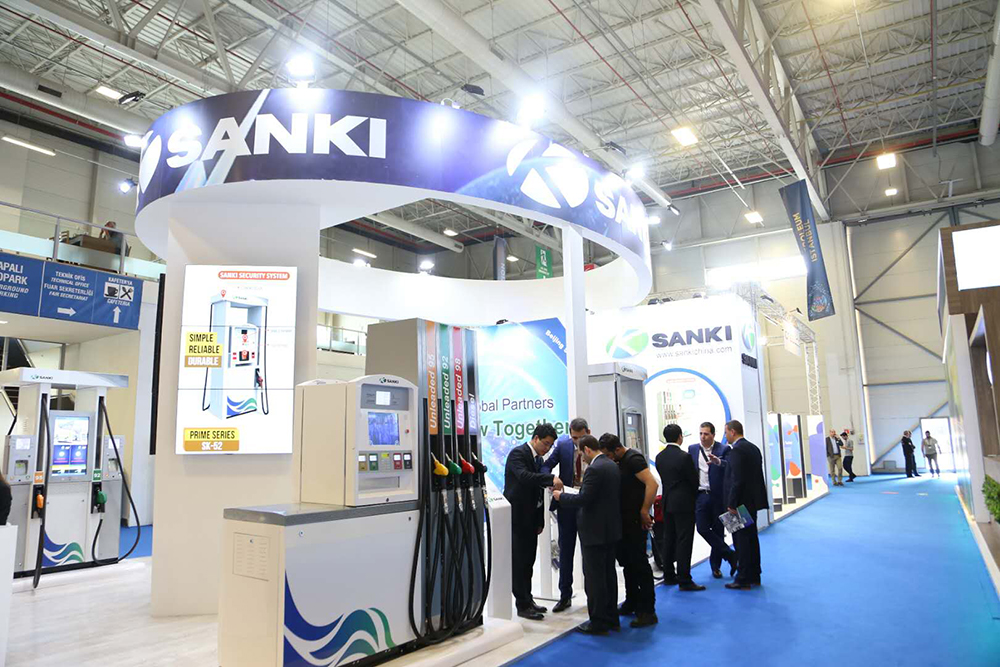

Venue: Tuyap Exhibition and Convention Center, Büyükçekmece, Turkey

“Best point of Oil, LPG, Mineral Oil, Equipment and Technology Exhibition”

Petroleum Istanbul is a 3 day event being held from 28th – 30th March 2019 in Istanbul, Turkey. Petroleum Istanbul, the largest trade fair for Petroleum Upstream and Downstream Equipment, Technology and Services in the Eurasia Region produced extremely positive results: products and services from 81 exhibitors were on display on more than 4,800 square metres of net exhibition space.